The implementation of the Goods and Service Tax on July 1st 2017 has led to one of India's greatest tax reforms of all time. GST is a comprehensive tax levied on the supply of goods and services that replaces all other indirect taxes such as central excise duty, state VAT, central sales tax, purchase tax, etc. So, whether you are a trader, manufacturer or a service provider, you need to register under GST to file returns.

Under the recently implemented Goods and Services Tax system in India, we come across various new terms every day. This makes it hard for a common people to understand the new structure and processes. One of these terms is GSTIN. We all see this written on bills, receipts, etc and the question arises what is it? What is its significance? How to get GSTIN? What are the types of GST? How to file GST?

What is GSTIN?

GSTIN, is short for Goods and Services Tax Identification Number a unique identification number that has been assigned to dealers and service providers based on their work type , location etc. The concept of GSTIN is being introduced basically for the facilitation of the people as well as government authorities involved in the taxation system throughout the country under the regime 1 Country 1 Taxation.

Means All taxpayers are brought together under one single umbrella to smooth the way for various administrative processes. Therefore, all taxpayers will be assigned with a GSTIN

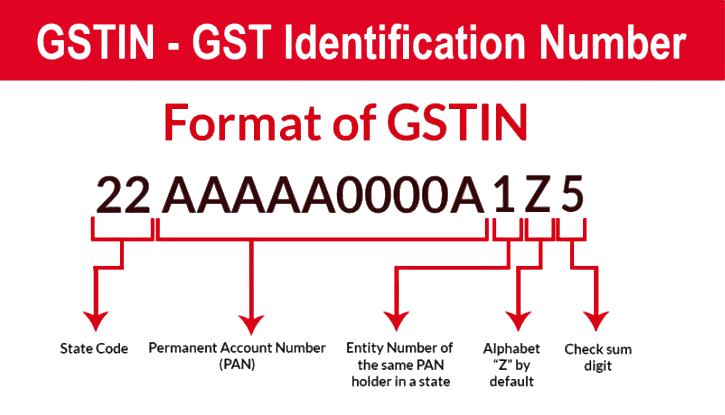

GST Number Format

Here comes the interesting part -– what is the structure of GSTIN and How it differs from one state to another or business to business in India?

GSTIN is a 15-digit number, which is unique for every taxpayer.

The first two digits of it are state code according to the Indian Census 2011.

Every state of India has a unique code assigned to it.

The next ten digits of GSTIN comprises of PAN number of the respective taxpayer.

The next digit, that is, the thirteenth digit of GSTIN will be the entity of the same taxpayer in a state.

The fourteenth character will be Z by default for everyone.

The last character of GSTIN will be either a letter or a number, it is basically a check code.

How to Register Your Business to Get GSTIN?

The next thing in which most of the businessmen, dealers and service providers find difficulty is obtaining GST number. It is very obvious to be perplexed about new procedures and requirements until and unless you find the right information about things.

Obtaining GSTIN is a very easy process, once your application for the same gets approved by the GST officer, you’ll be allocated with a unique GST number. Now the question comes of how to get GST number in India? Where to apply for it? What all documents are required for it?

To obtain your unique GSTIN, you are required to register yourself. The registration can be done on GST Online Portal or GST Seva Kendra set up by the Government of India. To register, a set of documents are required which includes :

Permanent Account Number (PAN)

Indian mobile phone number

E-mail address

Place of business

Registration application with all mandatory details

Jurisdiction details

Bank account number from India

IFSC code of same branch and bank

At least one Proprietor/ partner/ director/ Trustee/ Karta/ Member with valid PAN

An authorized signatory who is a resident of India with valid details and PAN

Once, this GST registration procedure is done and the GST officer approves your application, you’ll be assigned a GSTIN in the prescribed GST number format. It should be noted that the registration fee for obtaining GSTIN is nil. It is absolutely free of cost.

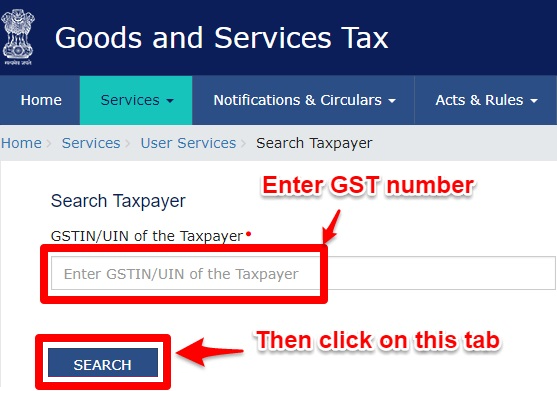

How and Where to Verify the GST Number?

To verify the GSTIN you can visit the official website of Goods and Services Tax, click on Search Taxpayer option. Enter GSTIN in the correct GST number format or UIN of the Taxpayer, after that enter the captcha and submit it. Registered name of the business whose GST number you have entered will appear under ‘Legal Name of Business’.

In case you are a businessman or service provider and you’ve recently registered your business to obtain GSTIN according to the procedures mentioned above, then you’ll be assigned a provisional ID on a temporary basis till the time you don’t get your GSTIN.

Types of GST Returns

| S.No | Return | Particulars |

|---|---|---|

| 1. | GSTR 1 | Carries details of taxable goods or services, or both as well as that of outward supplies. |

| 2. | GSTR 2 | Carries details of inward supplies related to taxable goods and/or services, along with ITC claim. |

| 3. | GSTR 3 | Includes details of monthly returns based on finalised detail related to inward and outward supplies. It also includes details of total tax payable. |

| 4. | GSTR 4 | Carries details related to Quarterly Return filing, specifically for compounded tax liabilities of specific individuals. |

| 5. | GSTR 5 | Includes details of GST return filing for non-resident foreign individuals. |

| 6. | GSTR 6 | Serves as the form for Input Service Distributors to file returns. |

| 7. | GSTR 7 | Serves as the form facilitates Return filing for authorities initiating TDS. |

| 8. | GSTR 8 | Carries supply details for e-commerce operators along with the tax amount collected as per sub-section 52. |

| 9. | GSTR 9 | Serves as the form to file Annual Returns. |

| 10. | GSTR 9A | Includes details to file Annual Returns relative to Compounding taxable individuals registered u/s 10. |